When we think of brands that are dominating the luxury marketing space, there are a few leaders that come to mind. SSENSE, an online luxury retailer, seems to consistently have their finger on the social-media-meme pulse. JACQUEMUS, brand of choice by stars like Jennie Kim and Kendall Jenner, is leading the way when it comes to manufacturing virality.

While JACQUEMUS is the innovator of all innovators when it comes to social marketing, brands like Miu Miu, Bottega Veneta and Balenciaga follow closely behind. These brands consistently rank within the top 10 on the Business of Fashion Brand Magic Index, as well as The LYST Index, signaling that the brands are at the top of their marketing games. They produce campaigns and collections that have the internet talking for weeks on end — and their peers scrambling to keep up.

Although we’re in a digital-first age where online image holds weight, we still wonder if compelling campaigns are enough to compete with legacy fashion houses like Chanel and Hermès. It begs the question: is online influence enough to convert followers into consumers?

Legacy vs Luxury Marketing Dominance

JACQUEMUS is leading the charge in luxury marketing right now. The brand has perfected the art of social image and consistently challenges the way we think about traditional marketing. Their unique and consumable perspective is evident with campaigns like their viral bags-on-wheels.

On the other end of the spectrum, we have legacy brands that are very traditional in their marketing, such as Chanel, Dior and Hermès. These brands know their consumers are going to buy a bag regardless of how much they invest in their digital persona. Even though JACQUEMUS is at the top of the luxury marketing landscape, they are still working to gain the market share these legacy houses have.

The BoF Brand Magic Index

The BoF Brand Magic Index focuses on how brands balance the timelessness of their identity with the timeliness of the culture. According to their website, their goal is to identify “fashion’s most magical brands” by “assessing how effective they are in finding alignment, creating engagement and driving intent with customers.”

For example, “buzzy brands” are classified as those with low alignment, high engagement: “Driving conversation (and noise) but sometimes with a muddled identity that is not aligned with customers.” The brands in this category include Gucci, Celine, Ralph Lauren and Tommy Hilfiger.

“Sleepy brands,” which have high alignment, but low engagement: “Nurturing a loyal but sometimes niche customer base that understands the brand even if the brand itself does not inspire much engagement.” Examples include Tod’s, Dolce & Gabbana and Ferragamo.

“Lost brands” have low alignment and low engagement. BoF describes this as “lacking a cohesive identity while also failing to generate meaningful engagement.” This typically indicates they’re either in a period of strategic turnaround or currently changing creative leadership.

Lastly, a “magical brand” has high alignment and high engagement, “leading the zeitgeist and captivating audiences without compromising their underlying essence,” such as Dior, Louis Vuitton, Versace, Calvin Klein and Hermès. But JACQUEMUS, Maison Margiela and Miu Miu, although not on the level of fashions legacy brands, rank here as well due to their impeccable brand identities and ability to create relevant cultural moments.

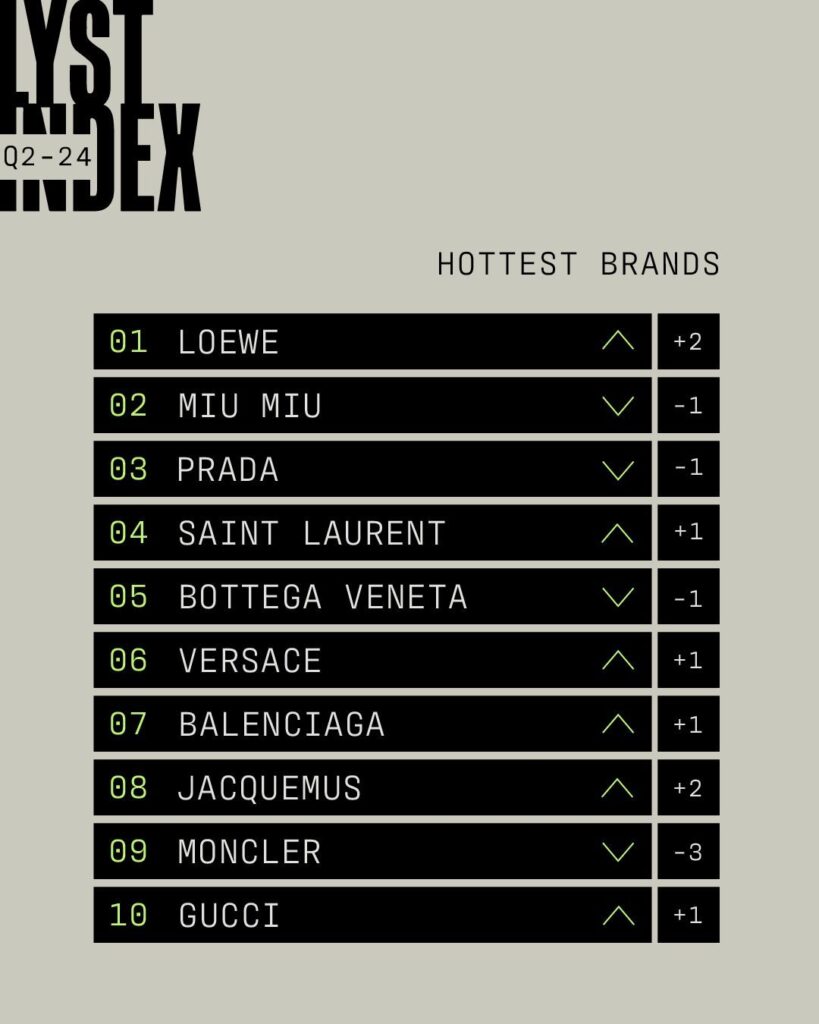

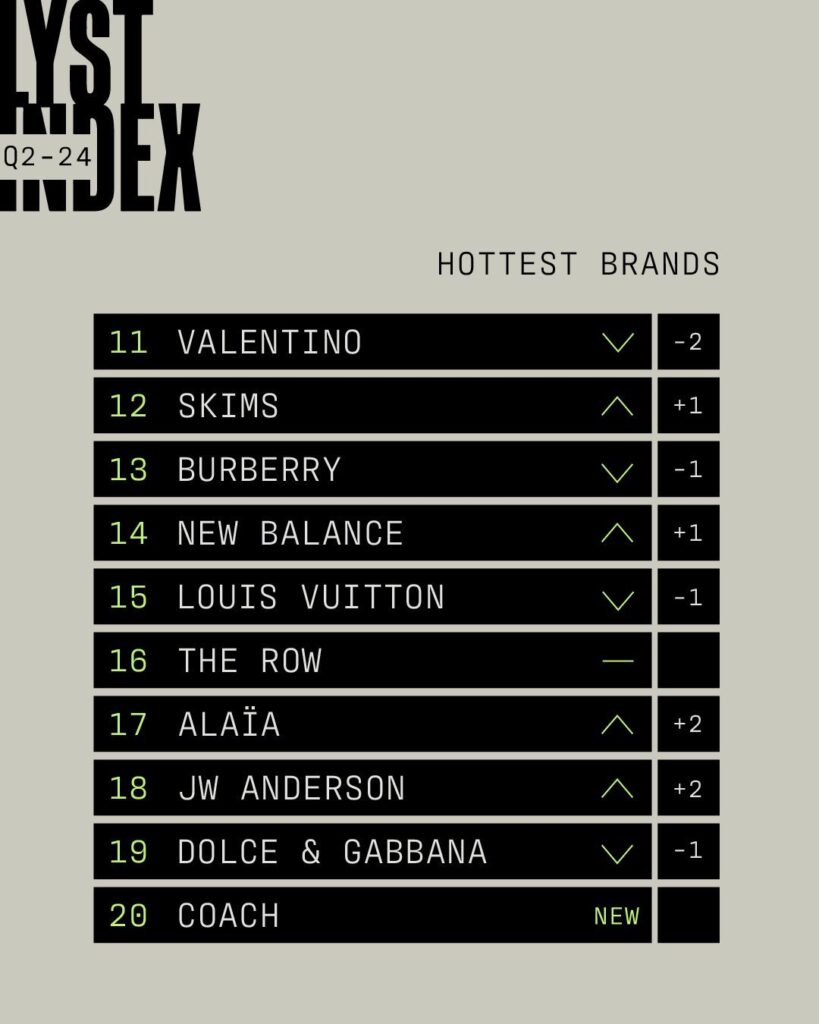

The LYST Index

As for The LYST Index, their website shares the following statement: “The LYST Index a quarterly ranking of fashion’s hottest brands and products compiled by LYST, the world’s biggest and most intelligent fashion shopping platform. With 200m shoppers a year and the biggest data set in fashion, Lyst is a unique source of global fashion intelligence. The formula behind The Lyst Index takes into account Lyst shoppers’ behavior, including searches on and off platform, product views and sales. To track brand and product heat, the formula also incorporates social media mentions, activity and engagement statistics worldwide, over a three month period.”

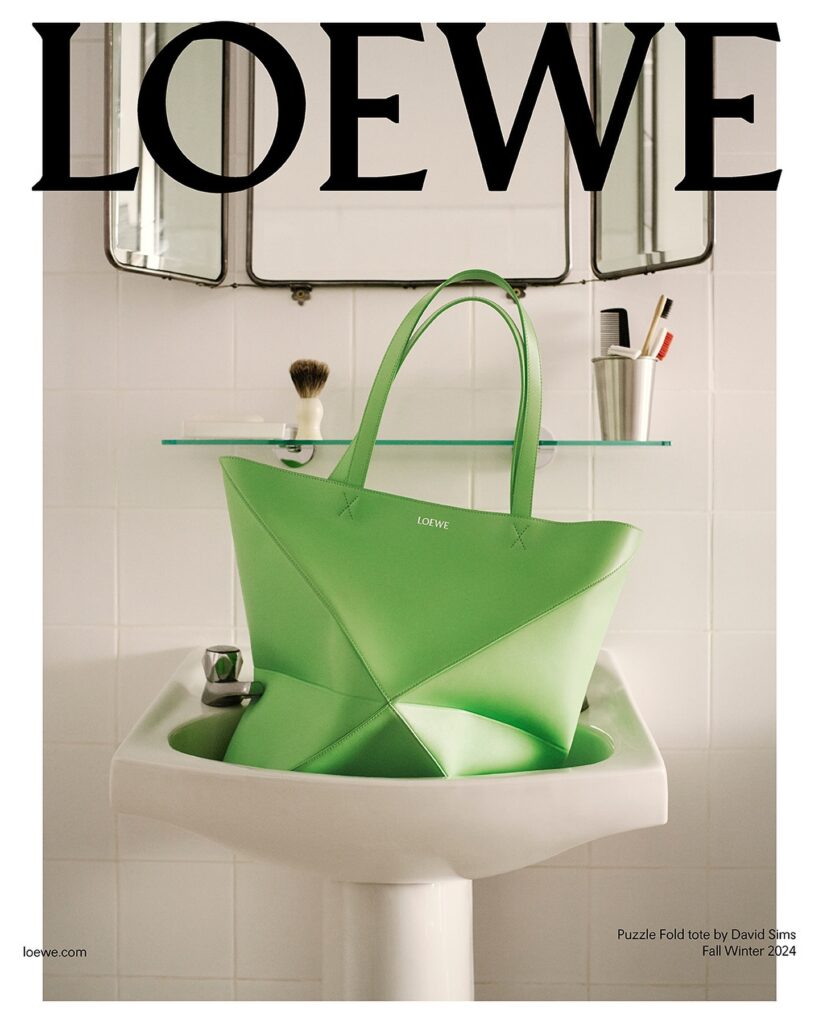

Loewe is currently ranked number one. In an Instagram caption, they posted: “From sponsoring the Met Gala, to the release of the highly anticipated Challengers movie; Loewe reclaims its title as hottest brand in the world. Balancing heritage with cultural relevance, desire for Loewe product is strong worldwide. Elsewhere, Coach has re-entered the Lyst Index, joining The Row, New Balance and Skims as the only four American brands in the chart.” Following Loewe, the top 10 is as follows: Miu Miu, Prada, Saint Laurent, Bottega Veneta, Versace, Balenciaga, Moncleur and Gucci.

With Chanel, LV and Hermès all missing from The LYST Index, we have to consider if their old school marketing approaches are as strong as their competitions’ social media strategies in driving sales in a digital-first era of shopping.

The Skims Effect

There are, however, cases where strong marketing trumps legacy – with Skims being a prime example. Their campaign with Charli xcx this summer is a perfect case study of the brands ability to resonate with their audience – and nail both turnaround time and cultural relevance. The brand remains timely and on the pulse, which maintains their position as a top brand that has been able to convert a massive following into loyal consumers.

In examples of brands like Skims, it’s evident that online influence is enough to covert followers into consumers. But as BoF tells us, the key to a fashion brand’s success is striking that sweet spot between identity timelessness and cultural timeliness: you can’t just have social media clout, but there’s no denying that it definitely helps.